Scrolling through the new Saks on Amazon storefront, you almost wouldn’t know you’re on Amazon.com, the world’s largest e-commerce everything store. Almost.

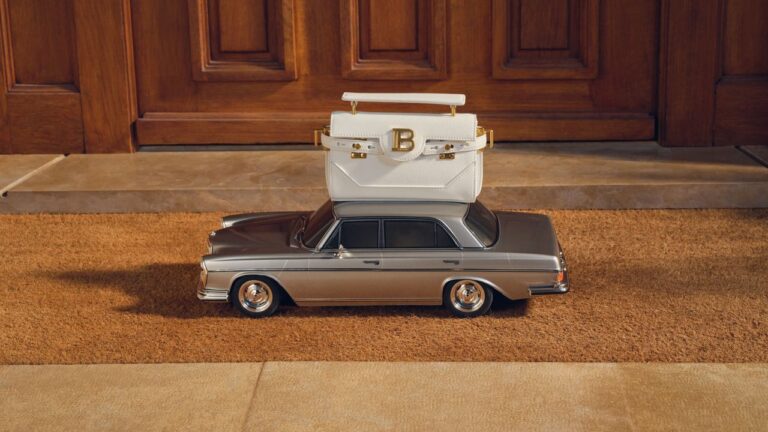

Roughly 110 fashion, makeup and skincare brands are listed in the storefront, including Stella McCartney, Balmain, Dolce & Gabbana, Area, Simkhai, Fear of God, Adam Lippes, Giambattista Valli and Rebecca Vallance, most with a limited selection available to shop. The user experience has familiar Amazon markers. A $1,890 Balmain cardigan comes with free one-day shipping for Prime members — along with a note that it’s sold and shipped by Saks Fifth Avenue. The editorial is minimal, with items from a $45 Chantecaille lipstick to a $4,150 Giambattista Valli midi dress presented in clean flatlays on white backdrops, sorted under the “Spring Fashion” buy.

But you’ll notice other features typical to shopping on Amazon are missing. Dynamic pricing, where the price tag fluctuates by size and colour based on demand, is not in play. And the product pages have been cleaned up and scaled back to include only item descriptions, recently viewed pages and an “About the Brand” section — even Amazon’s signature star ratings and reviews are gone. The Saks logo is featured several times. To hook in customers, a 10 per cent offer in exchange for signing up for Luxury Stores texts or emails is featured in a banner at the top of the page. But there’s little merchandising, with no related items or “you might also like” offerings. “It’s merchandising 101,” says Jessica Ramírez, co-founder of retail consultancy The Consumer Collective. “From a luxury experience, it doesn’t feel like what you would expect.”

For years, Amazon has tried to win over luxury brands to grow its selection and consumer base, targeting the more discretionary designer shopper. Amazon Luxury Stores — which Saks on Amazon replaces — first launched in September 2020 as a mobile-only experience with Oscar de la Renta as its first and only brand partner. The concept expanded since, with further brands like Sergio Hudson, Rodarte and Altuzarra, a European launch and tie-ups with resale and rental platforms Hardly Ever Worn It, What Goes Around Comes Around and Rent the Runway. But it’s been fledgling in the years since, with limited selection and a difficult-to-access landing page. Amazon’s model has long prioritised the cheapest prices, fast Prime shipping, strong reviews and product SEO for sellers — many of whom have spent years perfecting their Amazon strategies. It’s not something that most luxury brands have felt incentivised to invest in themselves, thanks to the clinical user experience and clashing priorities.

This could now change. When Saks merged with Neiman Marcus, creating the Saks Global group composed of Saks Fifth Avenue, Neiman Marcus, Bergdorf Goodman and Saks Off Fifth, it tapped outside companies, Amazon and Salesforce, to help get the deal over the line as investors. Salesforce’s role is that of a tech partner, particularly working on generative artificial intelligence, while it was clear that Amazon would be an e-commerce partner. Any fears that designers might have had that selling on Amazon could jeopardise relationships with other retailers — say, Bergdorf Goodman — would be quelled. Everyone’s now in bed together anyway.

The relaunch of Amazon Luxury Stores with Saks also comes as luxury e-commerce platforms have largely broken down, limiting options where designer brands can sell online outside of their own websites. “It’s another touchpoint,” says Ramírez. “For independent brands, there’s a white-space opportunity in terms of non-traditional retail partners.”

Designer brands have to opt in to be included on the Amazon-Saks storefront, meaning it’s unlikely that major luxury brands with significant distribution networks of their own will be available. But this could be a smart move for independent brands. It’s been a rocky road in recent years for this cohort of designer labels, thanks to disruptions in wholesale retail — and Saks has had its own hand in that. Earlier this year, a brand memo rocked Saks vendors when Saks Global CEO Marc Metrick let them know the company would be changing its payment terms from the standard 30-day window to 90 days. It was a blow to brands operating on thin margins already; but many designers Vogue Business spoke to acquiesced that ultimately, they wouldn’t pull their inventory. They need Saks as a partner to reach customers, even if terms aren’t in their favour. “We have all this extra inventory — we need to figure out the best way to move it,” one designer said.