Business reporters, BBC News

Getty Images

Getty ImagesThe UK jobs market has continued to weaken, making the prospect of an interest rate cut next month even more likely, analysts say.

The unemployment rate has risen to 4.7%, its highest in four years, while the number of job vacancies has now been falling continuously for three years.

The annual rate of pay growth in the three months between March and May also slowed to 5%, the Office for National Statistics (ONS) said.

The government said “we need to go further” to improve the economy, while the Conservatives said the unemployment rise was a “disgrace”.

Earlier this week, in an interview with the Times, the Bank of England governor Andrew Bailey indicated there could be larger cuts to interest rates if the jobs market showed signs of slowing down.

Most economists are predicting a cut – though some say it would be unwise to encourage spending while inflation is still rising.

Many analysts have said that April’s rise in employer national insurance contributions (NICs) has discouraged firms from hiring.

While the unemployment rate has risen, the ONS has said the figure needs to be treated with caution due to problems with how the data is collected.

However, Paul Dales, chief economist at Capital Economics, noted that other ONS data shows the number of people on PAYE payroll has fallen in seven of the eight months since Chancellor Rachel Reeves announced the NICs rise.

Mr Dales said this trend “clearly shows businesses are offsetting the rises in their costs by reducing headcounts”.

Shadow work secretary Helen Whately said “each and every job loss is a devastating blow to hardworking families across the country”, adding “worse is yet to come under this punishing Labour government”.

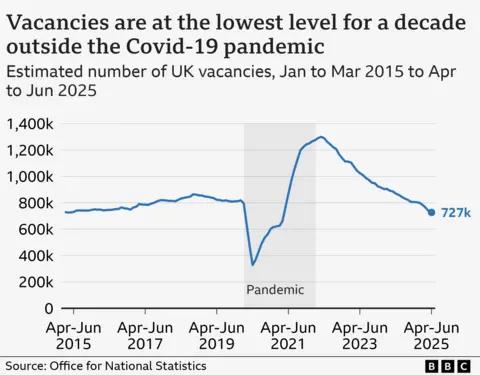

The ONS said the number of vacancies fell again to 727,000 for the April to June period, marking three continuous years of falling job openings.

It added that survey data suggested that some firms may not be recruiting new workers or replacing ones who have left.

The number of job vacancies is now at its lowest in 10 years, excluding the plunge seen during the pandemic when lockdowns stopped firms from hiring.

Yael Selfin, chief economist at KPMG UK, said the “slowing pay growth opens the door for an interest rate cut in August”.

“The impact of April’s tax and administrative changes has led to a marked slowdown in hiring activity among firms,” she added.

“With domestic activity remaining sluggish, the [Bank of England] will likely want to provide support via looser policy to prevent a more significant deterioration in the labour market.”

The ONS said the inactivity rate, which is the percentage of the population not looking for work, has fallen to 21% from 22.1% this time last year, but it remains above pre-pandemic levels.

Employment Minister Alison McGovern said that “for people in areas with the highest economic inactivity, we are funding new work to make sure barriers to employment are removed”.

‘We’re managing by the skin of our teeth’

Andrew Teebay

Andrew TeebayPeter Kinsella runs two Spanish restaurants in Liverpool City centre and says this is the toughest period for the business since the financial crisis in 2008.

He says the increase in employer national insurance contributions has “really impacted our recruitment. We employ fewer people than we did in March.”

Peter has cut staffing hours, decreased opening times, and invests less in repairs in the restaurant to make money go further.

“We’re managing, but by the skin of our teeth”, he says.

He’s also being more cautious about hiring new staff, often reluctantly not replacing people who leave the business.

“It’s a fantastic thing to take people on, to give them work. So we want to avoid at all costs those things that have a real impact on people’s lives, but we’ve had no choice”.