How did Jeffrey Epstein, a college dropout who started off teaching math and physics, make a huge fortune?

At least at the beginning, the man from a working-class family in Coney Island, New York, had luck on his side.

Through connections, Epstein got a job at investment bank Bear Stearns, which gave him insight into high finance. In 1980, he was made a limited partner.

After five years, he left the bank but used his time there and contacts as a sign of credibility.

Jeffrey Epstein was a man of mystery and finance

After he left Bear Stearns, Epstein’s name resurfaced in financial circles, but it was hard to say what he actually did.

“He was a cypher,” said Charles Gasparino, a senior correspondent at Fox Business Network in Netflix’s 2020 documentary “Jeffrey Epstein: Filthy Rich.” Normally, people on Wall Street leave trails, but Epstein was elusive.

“Here was this guy that people talked about a lot, that didn’t have much of a footprint in the investment world,” said Gasparino.

Epstein’s alleged links to a Ponzi scheme

Steven Hoffenberg, the former CEO of Towers Financial Corporation, claimed to know part of the story.

In the late 1980s, he hired Epstein, who became his “partner in crime,” according to an interview in the Netflix documentary. Hoffenberg was running what turned out to be a $460-million (€387-million) Ponzi scheme.

Epstein “took over the securities side, the fake assets side, he was manipulating stock price and trading stock illegally,” said Hoffenberg.

In 1993, it all came crashing down. Hoffenberg pleaded guilty and was sentenced to 20 years in prison. Epstein was never charged with any crime, so it is hard to know what, if any, part he played and what he gained financially.

The Les Wexner connection

In the mid-1980s, Epstein met Les Wexner, the Columbus, Ohio-based retail mogul behind Victoria’s Secret and The Limited. Epstein promoted himself as a financial advisor and got the keys to the billionaire’s finances in 1991.

Epstein assumed control of Wexner’s personal financial affairs, paid himself handsomely and acquired a property portfolio and a private jet.

He and Wexner parted ways in 2007 as a scandal enveloped the financier. Only then did Wexner discover that Epstein had “misappropriated vast sums of money from me and my family,” as he later wrote.

Where did Jeffrey Epstein’s initial wealth come from?

Epstein had stolen or misappropriated several hundred million dollars belonging to Wexner, according to a report by US prosecutors recently made public.

“That misconduct, together with fees that Epstein paid himself for his services to Wexner, appears to account for virtually all of Epstein’s wealth,” according to lawyers in the report.

Epstein sold himself a private jet that belonged to Wexner for a fraction of the cost. He did the same with a townhouse in New York City. Epstein also bought property on behalf of Wexner and then resold it to himself at discounted prices, the report adds.

In 2008, Epstein returned $100 million to Wexner in a private settlement rather than face a public court case. Wexner cut all ties with Epstein but never filed an official complaint.

Still, Epstein walked away with assets and a huge pile of cash. Since Wexner did not go public for over a decade, no one knew what happened.

How Epstein exploited Wexner’s links

But Wexner gave Epstein something else, too. If Wexner was perceived as trusting Epstein, others could reasonably trust him and his financial advice. Epstein used this credibility to access a growing list of who’s who.

He was not afraid to throw around names like Clinton and Rockefeller. It seemed to work, and prominent individuals were pulled into his personal network, such as private equity billionaire Leon Black.

Over the years, there were quiet allegations of excessive fees or exploitation, but it appears Wexner is the only one to publicly claim outright theft.

The role of JP Morgan and Deutsche Bank

Even after Epstein became a registered sex offender in 2008 and spent time in jail, many still came to him for advice, a fact underscored by the latest Department of Justice document release.

Many companies were also happy to get his business. His banks have come under special scrutiny.

Epstein used JPMorgan from 1998 until 2013, when it closed his accounts. A decade later, without admitting any wrongdoing, the bank paid $75 million to settle claims by the US Virgin Islands and $290 million to settle a lawsuit by a group of Epstein’s victims.

After he was forced out of JPMorgan, Deutsche Bank let Epstein open an account in 2013. Later, he had approximately 40 accounts before the bank ended its relationship shortly before his death.

The bank has said it regrets its connection with Epstein and agreed to pay a $75-million settlement to a group of his victims without admitting wrongdoing.

What happened to Jeffrey Epstein’s fortune?

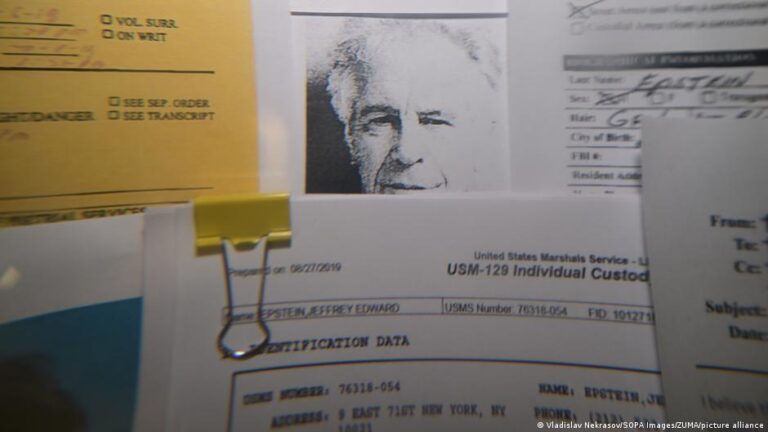

Epstein was arrested on July 6, 2019, and charged with sex trafficking of minors. He was found dead in his jail cell on August 10 the same year.

When his will went to probate court in the US Virgin Islands — where he was a resident — it had a list of assets totaling $577 million, including $56.5 million in cash and nearly $194 million in hedge funds and private equity investments plus $112 million in equities. It also listed the companies that owned his properties in the Virgin Islands, New Mexico, New York City, Palm Beach and Paris.

But taxes, upkeep, legal fees and large settlements have eaten away at the estate. This has not stopped people from trying to explain where it originated in the first place.

The New York Times concluded a months-long investigation in December 2025. After digging through thousands of pages of records, the paper concluded that Epstein built his fortune through “scams, theft and lies.”

“Epstein was less a financial genius than a prodigious manipulator and liar,” according to the paper. “Again and again, he proved willing to operate on the edge of criminality and burn bridges in his pursuit of wealth and power.”

Edited by: Ashutosh Pandey