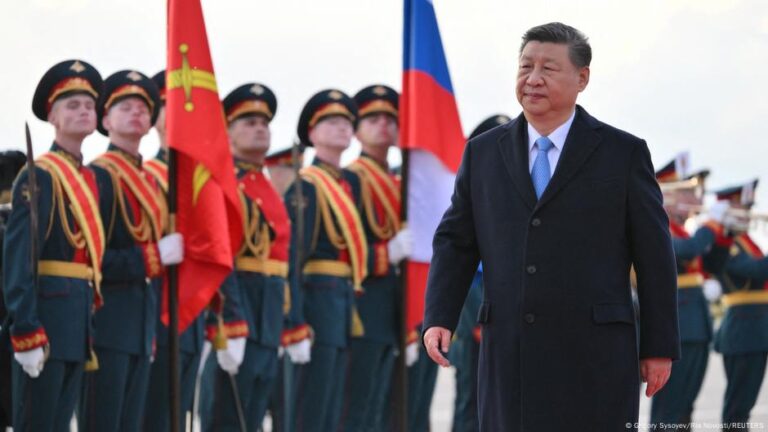

Chinese President Xi Jinping is in Moscow this week for Russia’s Victory Day Parade, where his Russian counterpart, Vladimir Putin, unleashed a display of military might to help cement ties with Beijing.

The parade, a celebration of the 80th anniversary of the Soviet triumph over Nazi Germany in World War II, aimed to showcase Russia’s resilience and ambition on the global stage.

At the Kremlin shortly after, Xi declared that China stands shoulder-to-shoulder with Moscow against “hegemonic bullying,” a pointed jab at US President Donald Trump’s tariff onslaught and crippling sanctions on Russia over its invasion of Ukraine.

“The mutual trust between China and Russia grows ever deeper, with pragmatic cooperation forging an unbreakable bond,” Xi said.

Björn Alexander Düben, an expert in Russia-China relations at China’s Jilin University, thinks Xi’s visit has a “highly symbolic element,” noting that, apart from Brazil’s President Lula da Silva, Xi was the only major world leader to attend the parade.

Düben noted a “personal rapport” between the two leaders and described how Xi “devotes more time to his interaction with Putin than practically any other international leader.”

Russia needs China more than ever

As Western sanctions choke Russia’s economy over the Ukraine war, Moscow increasingly counts on Beijing as a lifeline for energy and raw material exports.

China has risen to become Russia’s top economic partner, with bilateral trade soaring to $244 billion (€216 billion) last year. In February 2022, the two countries signed a “no limits” economic, military, and diplomatic partnership to counter Western influence.

Since the war’s onset, Russia’s exports to China have skyrocketed by 63% to $129.3 billion, while Chinese imports have helped bolster Moscow’s wartime economy, binding the two nations closer than ever.

Instead of buckling under the strain of the conflict, Sino-Russian ties have surged to new heights. While maintaining neutrality in the war, Beijing struck a shrewd deal with the Kremlin, snapping up discounted Russian oil and gas, as European nations cut their reliance. Russia is now China’s top source of crude oil imports, supplying around a fifth of imports.

The two powers have also tightened military bonds, ramping up joint war games and sharing cutting-edge defense technologies.

While Russia’s economy has proven more resilient to Western sanctions than most experts had expected, without China’s economic support, Moscow would be in a “deep mess,” Düben told DW.

China’s support props up war effort

As well as the expanded energy trade, Düben said China has given Russia access to manufactured goods and technologies that it cannot produce and that Western states no longer export to Russia.

The Yilin University associate professor said that without China’s dual-use goods (civilian and military), “Russia’s armed forces would probably not be able to continue their military campaign against Ukraine.”

One of Trump’s aims with such high tariffs on Chinese imports was to box Beijing into a corner against Washington and the rest of the world. Undeterred, China has fought back, cautioning nations rushing to ink trade deals with the US against undermining Chinese interests. In its dealings with Washington, Beijing has remained defiant but calculated.

[In responding to Trump] “China is positioning itself as a steady counterweight to an erratic, protectionist US, showcasing its alliance with Moscow as a bedrock of global stability,” said Düben.

US secondary sanctions impede trade

With US tariffs on China soaring to unprecedented highs and American markets slamming shut for Chinese exporters, they may seek to explore new opportunities in Russia’s market, though much smaller than the US.

But they’ll have to overcome US secondary sanctions imposed on Moscow to stop entities in third countries exporting to Russia, which made many Chinese banks hesitant about working with their Russian counterparts.

“These secondary sanctions have proven a major irritant in Sino-Russian economic interaction and a substantial obstacle in further expanding trade,” said Düben. “But as trade relations with the US become less attractive for China, Chinese banks and other businesses might be more inclined to ignore US sanctions threats in their dealings with Russian businesses.”

Earlier this year, the secondary sanctions briefly disrupted Russia’s oil exports to China, when the US Treasury targeted 183 vessels, two of Russia’s major oil producers and related firms with sanctions. The crackdown caused an 18% drop in Russia’s crude exports to China in February. However, thanks to a Chinese workaround involving alternative vessels and payment systems, Russia’s shadow fleet has since sustained the trade.

While Düben notes that although a focus on Russia may further boost Sino-Russian trade, he expects that growth to “remain modest” compared to China’s broader global commerce.

Siberia 2 pipeline at ‘active stage’

A centerpiece of the Putin-Xi talks during the Chinese president’s visit is the proposed Power of Siberia 2 gas pipeline, set to channel 50 billion cubic meters of Russian gas annually from Yamal in northwest Siberia to China via Mongolia.

Moscow has pursued Beijing relentlessly for years to finalize the project, but the pipeline’s route remains unresolved underscoring China’s upper hand. Russian Energy Minister Sergey Tsivilyov revealed Thursday that negotiations are at an “active stage,” though a deal is unlikely to be sealed during Xi’s visit.

This lopsided dynamic lays bare Russia’s waning leverage in a Beijing-led partnership, cementing China’s dominance as Moscow aligns with its global ambitions.

“Given Russia’s unprecedented dependence on China, Moscow is increasingly tied to Beijing’s interests … and is now increasingly a supplicant,” Düben said.

Edited by: Rob Mudge